Kotak Manufacture in India Fund

Grow with India

It invests in companies engaged in manufacturing activities, giving you an opportunity for wealth creation alongside the growing Indian economy.

PREFFERED AMFI REGISTERED MUTUAL FUND DISTRIBUTOR

MILESTONE GLOBAL MONEYMART PRIVATE LIMITED

Hurry now before NFO ends!

00

Days

00

Hours

00

Minutes

00

Seconds

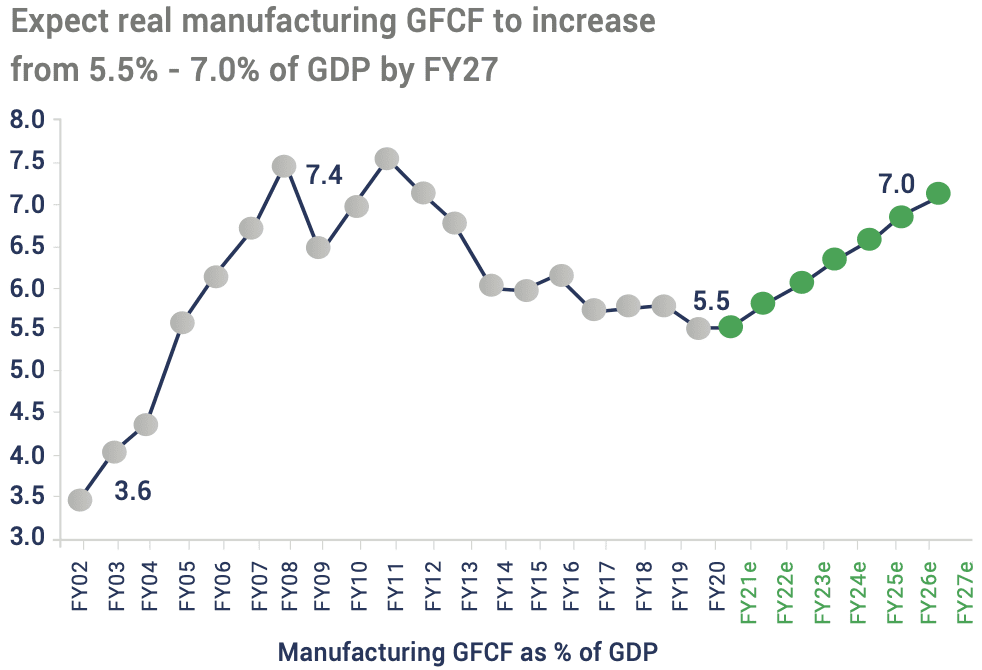

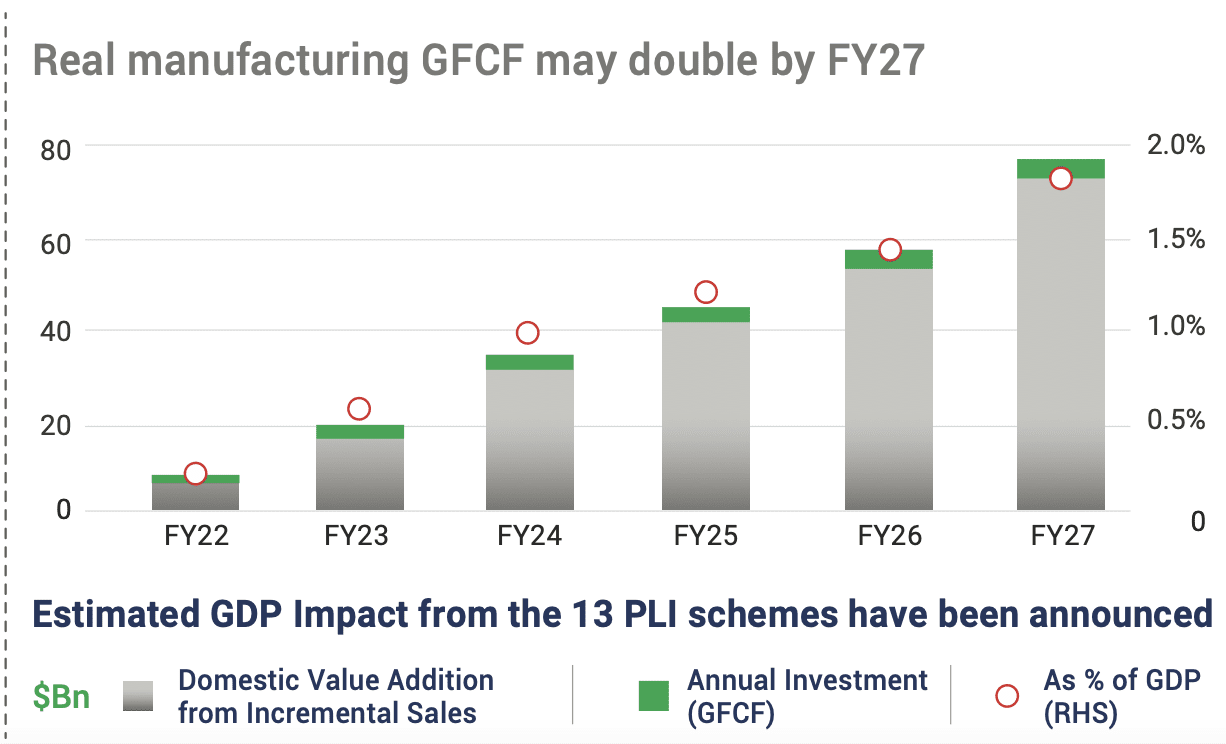

Manufacturing GFCF as a percentage of GDP is expected to rise

Manufacturing GFCF as a percentage of GDP is expected to rise

Gross fixed capital formation (GFCF), also called "investment", is defined as the acquisition of produced assets (including purchases of second-hand assets), including

the production of such assets by producers for their own use, minus disposals.

Source: CMIE, Antique

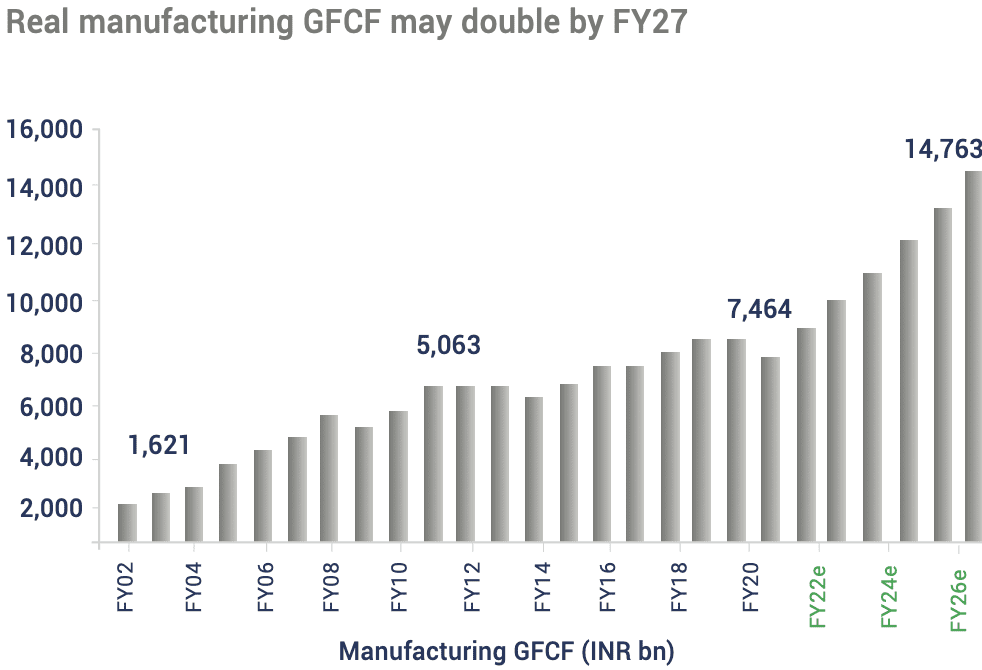

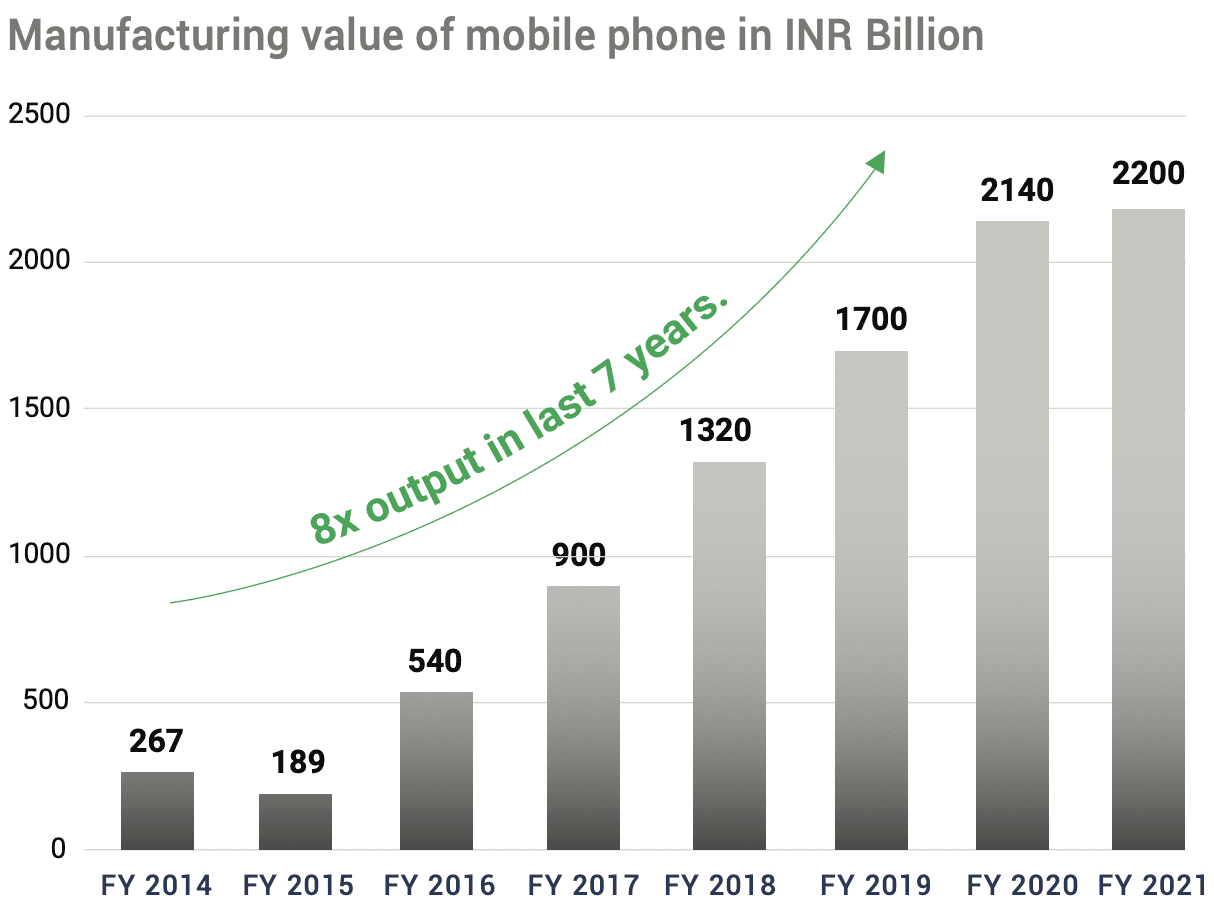

Indian manufacturing sector is poised to bring renaissance

Why invest in Kotak Manufacture in India Fund now?

Why invest in Kotak Manufacture in India Fund now?

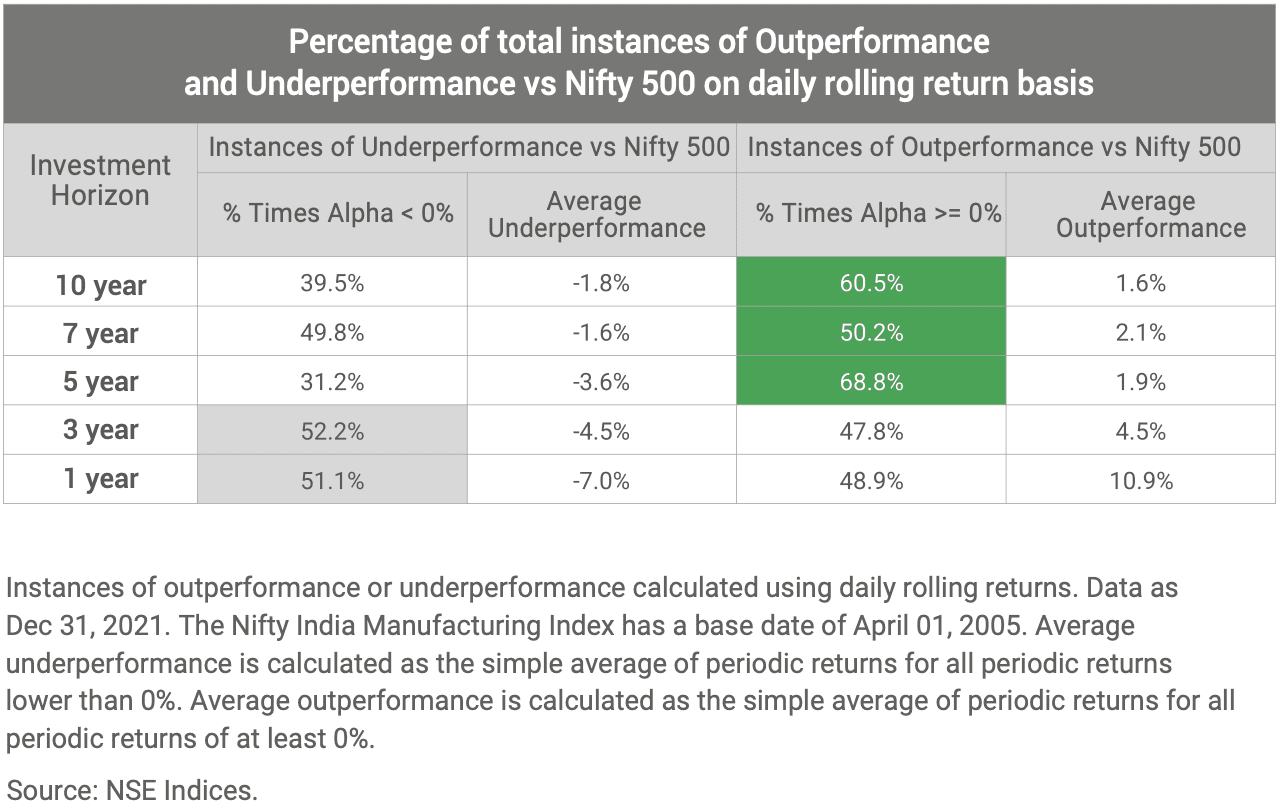

Recent underperformance provides attractive allocation zone

Data as Dec 31, 2021. Source: NSE Indices

Data as Dec 31, 2021. Source: NSE Indices

Name of the Scheme: Kotak Manufacture in India Fund

Type of fund: An open ended equity scheme following manufacturing theme.

Benchmark Name: Nifty India Manufacturing Total Return Index

Investment Objective: The scheme shall seek to generate capital appreciation by investing in a diversified portfolio of companies that follow the manufacturing theme. However, there is no assurance that the objective of the scheme will be realized.

Fund Manager(s): Mr. Harish Krishnan for Equity Mr. Abhishek Bisen for Debt

Minimum Application Amount (During Continuous Offer): ₹ 5,000/- and in multiples of ₹ 1/- for purchases and of ₹ 0.01/- for switches

Minimum Investment during NFO: Initial Purchase: ₹ 5,000/- and in multiple of ₹ 1/- for purchase and for ₹ 0.01/- for switches. SIP Purchase: ₹ 500/- Subject to a minimum of 10 SIP installments of ₹ 500/- each.

Plans: Regular Plan and Direct Plan

Options: Growth and Income Distribution cum capital withdrawal (IDCW) (Payout and Reinvestment)

The NAVs of the above Options will be different and separately declared; the portfolio of investments remaining the same. Investors are requested to note that, where the actual amount of IDCW payout (for units held in Physical) is less than Rs. 500/-, then such IDCW will be compulsorily reinvested.

Entry Load: Nil

Exit Load: For redemption / switch out of up to 10% of the initial investment amount (limit) purchased or switched in within1 year from the date of allotment: Nil. If units redeemed or switched out are in excess of the limit within 1 year from the date of allotment: 1% If units are redeemed or switched out on or after 1 year from the date of allotment: NIL.